A recent flurry of news centered around a Wall Street Journal article which discussed Goldman Sachs purchase of $2.8 billion worth of bonds of the Venezuelan state oil company, Petróleos de Venezuela S.A. (also known by its Spanish acronym PDVSA, pronounced pay-day-vay-sa) for 31 cents on the dollar which mature in 2022.

A recent flurry of news centered around a Wall Street Journal article which discussed Goldman Sachs purchase of $2.8 billion worth of bonds of the Venezuelan state oil company, Petróleos de Venezuela S.A. (also known by its Spanish acronym PDVSA, pronounced pay-day-vay-sa) for 31 cents on the dollar which mature in 2022.

The Current Situation

As you may or may not know, Venezuela is in the midst of an economic and political crisis that has been brewing since the collapse in the global oil price in 2007-2008. The hard left government of Hugo Chavez and now his predecessor Nicolas Maduro, which has been in power since 1999, increasingly nationalized most of the country’s foreign and domestic industries. Many of the original workers of these companies were sacked and replaced with government cronies. In addition, under the populist guise of “making these goods affordable for the people” the government set prices so low on the goods of the newly nationalized industries that it no longer made economic sense to make them because the prices were far below production cost.

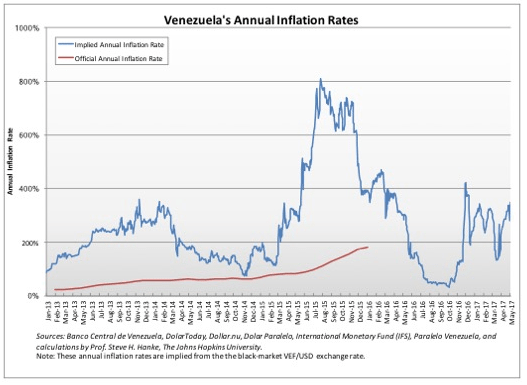

Furthermore, the government has strictly controlled the supply of dollars and fixed the exchange rate far below what the free market rate as they printed local currency to meet domestic obligations, setting off triple digit inflation. The results of this can be seen in the official exchange rate versus the implied annual inflation rate.

It has been a slow moving car crash for many years but is now accelerating as demonstrators take to the streets where 60 have died in protests against the government’s attempt to dissolve the opposition parliament. Basic goods and food items have been scarce for some time and recent studies have shown that the average Venezuelan has lost 19 pounds in the last year due to food scarcity.

The government has the ability to strictly control dollars because PDVSA is 100% owned by the government and at the moment, oil revenues are providing 95% of all the foreign currency entering the country, essentially giving the government not only a monopoly on oil production but on foreign currency as well.

So Why Buy Their Bonds?

Goldman and other investors are betting that since PDVSA is essentially the only source of dollars the government has access to, that they want to keep the tap on in order to keep their government in power. The government has prioritized interest payments over the purchase of food for its people to make interest payments recently which prompted Ricardo Hausmann, a former Venezuelan minister now at Harvard to dub these “hunger bonds”.

Hausmann has argued that JP Morgan Chase should exclude Venezuelan-government bonds from the emerging market bond indices it compiles. He focused his attention on JP Morgan because it is the most widely quoted indices for emerging market bonds.

Goldman has rightly pointed out that mutual funds and exchange traded funds run by some of the largest industry players such as BlackRock and Vanguard also have purchased these bonds and that Goldman purchased them at market price on the secondary market and not directly from the government.

What This Has to do With the Little Guy

From the big hedge fund investor to the small retail investor clacking away on his computer, in this low interest rate environment, everyone is looking for yield, but Mr. Hausmann brings up a good point. Governments like those in Venezuela have in the past, looked towards the large international banks to keep them afloat through bond purchases or direct lending. But now the structural shift of investors towards ETFs and index funds has shifted massive wealth and power to asset managers who just follow the makeup of an index on their investor’s behalf. As a recent article in The Economist pointed out, one of the largest bond ETF’s derived up to 10% of its overall yield from these bonds alone, so that made me curious to dig a little deeper and see what exactly some of these bond ETFs owned.

The largest emerging market bond ETF fund is the iShares J.P. Morgan USD Emerging Markets Bond ETF (EMB). The ETF currently has a 12 month trailing yield of 4.67% and has 369 holdings with a weighted average maturity of 10.9 years. If currently holds $12.7 billion in net assets and has a net expense ratio of 0.40%. The ETF holds the bonds of 55 different countries with no country representing any more than 6.2% of the entire portfolio. Currently Mexico is the largest exposure. If we count the bonds of the Venezuelan government as well as those of PDVSA, this ETF holds $283 million worth of Venezuelan government bonds or 2.22% of the entire bond portfolio. This may not sound like much but if you own this ETF, you are part of an investor base that owns hunger bonds.

The next largest ETF in terms of market cap is the Power Shares Emerging Market Sovereign Debt Portfolio (PCY). This ETF tracks a different index, the Deutsche Bank Emerging Market USD Liquid Balance Index. The strategy is different in this index, it tracks the liquid dollar denominated bonds of “over 20” emerging markets. When I looked into it, the ETF currently has a trailing yield of 4.94% and has 84 holdings representing $4.5 billion in net assets with an expense ratio of 0.50%. Argentina holds the top spot in this ETF with 3.75% of the funds exposure to that country. Venezuela is represented here too, this ETF holds $132 million worth of Venezuelan debt which represents 2.9% of the portfolio. As can be seen below, the index has a curious mix of exposures that seem to have nothing to do with the size of the issuances via to the total emerging market universe of bonds with Sri Lanka being the top exposure and one single bond from Serbia making up 3.47% of the entire portfolio.

PCY Holdings

The third largest is the VanEck Vectors J.P. Morgan EM Local Currency Bond ETF (EMLC). This ETF tracks the J.P. Morgan GBI-EMG Core Index (GBIEMCOR), which is comprised of bonds issued by emerging market governments and denominated in the local currency of the issuer. Given that the Venezuelan currency, the Bolivar Fuerte is essentially worthless I wasn’t surprised to find that there were no Venezuelan holdings in this ETF. The trailing 12 month yield is currently 4.94%, the average portfolio maturity is 7.63. I was a bit surprised that the yield for this ETF was very close to the yield on the dollar denominated large ETFs. Not only are you taking the risk of the local government but you are taking the currency risk as will, which investors usually demand a higher yield to compensate for. But due to the shorter average maturity, the high exposure to Poland which is rated A2/BBB+ and a 5.08% exposure to supra-nationals like the Inter-American Development Bank which is AAA rated, it actually makes sense that the yield does not push above 5.0%.

EMLC Holdings

The argument that these big asset managers hold these bonds is a valid one. The three funds I looked at represent combined assets of $21 billion, but their holdings of Venezuelan bonds only total to $415 million out of a total debt stock of $125 billion or $38.75 billion at market rates. Given that the Goldman position is $2.8 billion this still represents a significant bet. The company may already be positioning itself for the post default negotiation and may be aware of some specific legal characteristics of the bonds that would give them a leg up on the market price in negotiation.

Either way, for purchasers of these ETFs, given that 2 of the largest hold these “hunger bonds”, not to mention holding debt of dubious governments like those of Russia, there should be at the least an awareness that the yield here arguably comes at the expense of a moral cost in some people’s eyes. What are your thoughts? Do any of the readers own these ETFs and what are your thoughts on this?

The information provided by www.cashchronicles.com is for informational purposes only. It should not be considered legal or financial advice. You should consult with an attorney or other professional to determine what may be best for your individual needs. www.cashchronicles.com does not make any guarantee or other promise as to any results that may be obtained from using our content. No one should make any tax or investment decision without first consulting his or her own financial advisor or accountant and conducting his or her own research and due diligence. To the maximum extent permitted by law, www.cashchronicles.com disclaims any and all liability in the event any information, commentary, analysis, opinions, advice and/or recommendations prove to be inaccurate, incomplete or unreliable, or result in any investment or other losses. Content contained on or made available through the website is not intended to and does not constitute legal advice or investment advice and no attorney-client relationship is formed. Your use of the information on the website or materials linked from the Web is at your own risk.